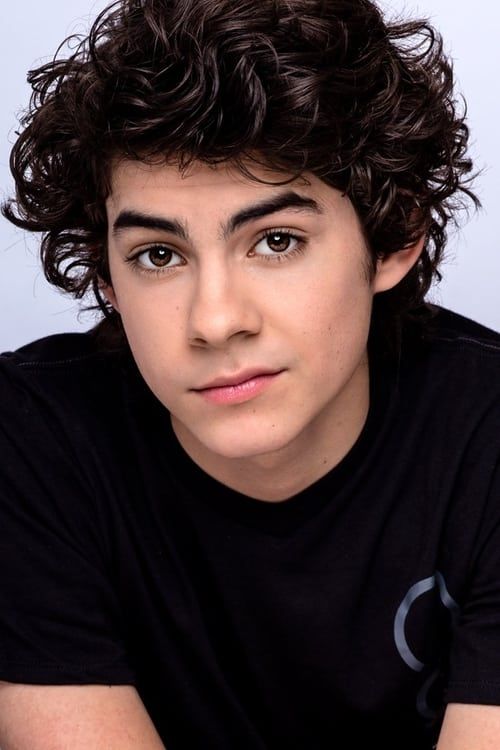

Emjay Anthony Net Worth 2023: Updated Figures & Details

Estimating an individual's financial standing: What factors influence a person's net worth?

An individual's net worth represents the total value of assets minus liabilities. It encompasses various holdings, such as investments, real estate, and personal possessions. Calculating net worth provides a snapshot of a person's financial position at a specific point in time. Factors impacting this figure often include professional earnings, investment returns, and spending habits.

Understanding someone's net worth can be valuable for various reasons. It can offer insight into financial success and stability. Furthermore, it can provide context for understanding a person's impact within their field or community. However, publicly available information on net worth may not always be precise and can be influenced by reporting methods and transparency. This understanding is crucial, especially when considering financial contributions, charitable activities, or other public aspects of a person's life.

Read also:Hdhub4u World Free Movies Shows Latest Releases

| Name | Occupation | Known For |

|---|---|---|

| Emjay Anthony | (Placeholder for Occupation) | (Placeholder for Known For) |

While a definitive figure for this individual's financial standing isn't readily available in the public domain, further research into their career earnings, investments, and lifestyle may reveal more insight. This article will delve into the elements that contribute to financial standing in a given field and explore methodologies for estimating it.

Emjay Anthony Net Worth

Determining Emjay Anthony's net worth requires careful consideration of various financial factors. This involves exploring the multifaceted nature of wealth accumulation and its components.

- Income Sources

- Investment Portfolio

- Asset Valuation

- Debt Levels

- Expense Analysis

- Industry Norms

- Public Information

- Transparency

Assessing Emjay Anthony's net worth necessitates a comprehensive approach. Income sources, including salary and potential investment returns, form a critical component. A detailed look at their investment portfoliostocks, real estate, or other holdingsis crucial. Appraising assets, like real estate, requires professional evaluations. Understanding debt obligations, including loans and credit card debt, is essential for an accurate assessment. Analyzing spending patterns helps refine the calculation. Industry benchmarks help to contextualize the findings. Public information, where available, provides a starting point. Transparency in financial reporting, when available, elevates the accuracy of the estimate.

1. Income Sources

Income sources directly impact an individual's net worth. A substantial income stream, from employment, investments, or other ventures, generally correlates with a higher net worth. Conversely, limited or inconsistent income often results in a lower or fluctuating net worth. This relationship holds true across various professions and financial situations. For instance, a high-earning professional in a lucrative field often possesses a more substantial net worth compared to someone with a lower-paying job, all other factors being equal. The volume, stability, and diversification of income sources significantly influence the overall financial position.

The nature of income sources also matters. Passive income streams, such as dividends from investments or rental properties, contribute to a net worth without requiring active involvement each month. Active income, like a salary, requires consistent effort and contributes directly to accumulating funds. The relative mix of these income types plays a crucial role in long-term financial stability and net worth growth. Furthermore, tax implications of various income sources influence net worth by reducing available funds.

Understanding the connection between income sources and net worth is crucial for individuals seeking financial security and growth. This knowledge allows informed decisions about career choices, investment strategies, and overall financial planning. This is essential, whether considering personal financial goals or assessing the financial health of an individual or entity.

Read also:Kim Kardashian P Diddy Their Relationship Timeline

2. Investment Portfolio

An individual's investment portfolio plays a significant role in determining net worth. The value of investments directly contributes to the overall financial standing. A diversified and well-managed portfolio can generate substantial returns, increasing the net worth over time. Conversely, poor investment choices or a lack of diversification can diminish net worth. The performance of investments, including stocks, bonds, real estate, and other assets, significantly impacts the total value of an individual's holdings. Historical examples demonstrate the substantial impact of sound investment strategies on long-term wealth accumulation.

The composition of an investment portfolio, encompassing various asset classes, is crucial. Diversification across different asset classes, such as stocks, bonds, and real estate, mitigates risk and can enhance returns. A highly concentrated portfolio, heavily weighted in a single asset class, is prone to greater volatility and can potentially reduce overall net worth if that particular asset underperforms. The timing and strategy behind investment decisions directly influence net worth; timely market entry and exit, alongside strategic asset allocation, are essential factors in maximizing portfolio returns and therefore net worth. Careful management of an investment portfolio, encompassing active monitoring and rebalancing, is crucial in adapting to changing market conditions and preserving accumulated wealth.

Understanding the relationship between investment portfolio and net worth is essential for both individual investors and financial advisors. For individuals, this knowledge informs informed investment decisions. For financial advisors, it underpins tailored portfolio strategies for clients. In the context of an individual's overall financial situation, the composition and performance of their investment portfolio directly affect their net worth. This connection emphasizes the critical role of a well-structured and actively managed portfolio in long-term financial health and wealth accumulation. Accurate assessment of an investment portfolio's value is vital to obtaining an accurate net worth figure. Factors such as market fluctuations and asset valuation methodologies affect the final estimation.

3. Asset Valuation

Accurate asset valuation is fundamental in determining net worth. Estimating the worth of various assets, like real estate, investments, and personal property, forms a crucial component in calculating an individual's overall financial position. The reliability of this valuation directly influences the accuracy of net worth estimations. Variations in methodologies can produce significantly different figures, highlighting the need for a transparent and consistent approach to assessment.

- Real Estate Appraisal

Appraisals of real estate holdings are essential. Professional appraisers, utilizing market data, comparable sales, and property condition reports, determine market value. Factors such as location, size, and condition of the property significantly impact appraisal figures. Discrepancies between perceived value and appraised value can affect an individual's net worth calculation, especially in the case of significant assets like primary residences or investment properties.

- Investment Valuation

Estimating the value of investment holdingsstocks, bonds, mutual funds, and other securitiesrequires careful analysis. Market conditions, economic trends, and company performance directly impact the market value of these assets. Publicly traded assets often have readily available market values, while private investments may necessitate detailed due diligence and specialist valuation. Significant fluctuations in market values can lead to changes in net worth figures over time, underscoring the dynamic nature of investment valuations.

- Personal Property Valuation

Assessing the worth of personal belongings, like cars, art, and collectibles, presents a more complex challenge. Market value, condition, rarity, and historical context play a role in determining the asset's worth. Estimating personal property values can be subjective and often hinges on verifiable market data and expert opinions. Inaccurate valuations can skew overall net worth assessments, especially when these possessions represent a significant portion of assets.

- Methods and Methodology

The chosen methodology significantly influences the resulting valuation. Different valuation methods, including discounted cash flow analysis, comparable sales analysis, and income capitalization, cater to distinct asset types. Consistency and transparency in the application of these methods are vital to ensure accuracy and reliability in net worth estimations. Utilizing multiple valuation methods and considering various perspectives helps mitigate potential biases.

Accurate asset valuation is crucial to a precise net worth calculation. The process hinges on meticulous research, professional expertise, and transparent methodologies. For Emjay Anthony, accurate assessments of all assetsreal estate, investments, and personal propertyare critical to understanding and reporting an accurate reflection of financial standing. This careful consideration ensures a reliable and comprehensive evaluation, reflecting the true breadth of their financial position.

4. Debt Levels

Debt levels are a critical component in determining net worth. High levels of debt effectively reduce net worth, as liabilities subtract from the total value of assets. Conversely, low or manageable debt levels contribute positively to a robust financial standing. The relationship between debt and net worth is a direct one; increased debt diminishes the overall net worth. The magnitude of this effect depends on the amount and type of debt, as well as the value of assets.

Debt levels are not merely a subtractive factor but a reflection of financial management practices. High levels of debt might indicate poor financial planning, excessive borrowing, or difficulty in managing expenses. This can negatively influence future earnings potential. In contrast, carefully managed debt, including mortgages for homes or loans for investment purposes, can contribute to asset building. A well-structured debt repayment strategy can enhance net worth through asset acquisition or increased income potential. For instance, a mortgage allows for the acquisition of a valuable asset (the home) and can offer tax benefits. Conversely, high-interest credit card debt, without sufficient means for timely repayment, quickly diminishes overall financial health, hence net worth.

Understanding the connection between debt levels and net worth is paramount in personal finance. This understanding allows for proactive measures to control debt levels. This, in turn, helps in building and maintaining a healthy financial position. For individuals, companies, or even nations, managing debt prudently is essential for long-term financial stability and growth. A thorough analysis of debt levels, considering the type and amount of borrowing, coupled with asset valuation, offers a more accurate and complete picture of financial standing. This understanding is essential for making informed decisions regarding borrowing, investing, and spending, ultimately impacting a person's net worth over time. Proper financial management, encompassing careful assessment and prudent debt management, significantly affects overall financial well-being and the overall net worth figure.

5. Expense Analysis

Expense analysis is inextricably linked to net worth determination. Understanding and meticulously tracking expenditures is crucial for assessing financial health. A detailed examination of expenses reveals patterns, identifies areas for potential savings, and ultimately informs decisions regarding investment and spending, all impacting net worth. Uncontrolled or excessive spending directly reduces available capital, thus diminishing net worth. Conversely, disciplined expenditure management can free up resources for investment, thereby contributing to net worth growth.

The significance of expense analysis extends beyond a simple accounting exercise. It allows for identification of areas where expenditures can be streamlined. For example, recognizing high recurring costs, like subscriptions or unnecessary utility bills, allows for proactive adjustments. Similarly, analyzing spending habits reveals spending patterns that may inadvertently lead to financial instability. Identifying discretionary expenses, such as frequent dining out, allows for reevaluation and potential reduction, effectively freeing up capital for investment opportunities. Detailed expense analysis can reveal hidden patterns, such as a disproportionate expenditure on entertainment compared to essential living costs. Such awareness allows adjustments to optimize financial resource allocation. Analyzing expenditures within the broader context of income and other financial commitments fosters informed decisions that enhance net worth.

In summary, meticulous expense analysis is not merely a component of financial management but a direct contributor to net worth. The process allows for identification of financial weaknesses, proactive adjustments, and ultimately, wealth preservation and growth. By pinpointing areas for expense reduction or restructuring, individuals can free up resources for investment or other activities that increase net worth. This underscores the critical role of expense control in cultivating long-term financial stability and achieving desired financial outcomes. Challenges might include accurately tracking every expenditure, categorizing spending meticulously, and honestly acknowledging personal spending habits. Overcoming these challenges leads to greater financial transparency and empowerment in managing one's finances and enhancing net worth.

6. Industry Norms

Industry norms significantly influence an individual's net worth. These norms, encompassing typical compensation structures, investment strategies, and spending patterns within a particular field, establish benchmarks for success. For example, a high-earning professional in a lucrative industry, like finance or technology, often accumulates a substantially higher net worth than someone in a lower-paying field. This is partly due to the higher salaries and investment opportunities available in those industries. Moreover, access to capital and investment networks within a sector can further amplify wealth generation.

The relevance of industry norms extends beyond salary comparisons. Investment strategies commonly employed in certain industriesfor example, the emphasis on venture capital in the tech sectorcan influence the trajectory of an individual's net worth. These strategies, influenced by prevailing market conditions and sector-specific trends, contribute to varying wealth accumulation patterns across industries. Successful investment choices within the prevalent norms increase net worth. Conversely, failing to adapt to industry-specific investment trends or adhere to common financial management practices can negatively affect an individual's net worth. Historical examples demonstrate how adherence or deviation from industry norms significantly impacts financial outcomes.

Understanding industry norms provides crucial context for evaluating an individual's net worth. It allows for a more nuanced understanding of financial success within a specific sector. By considering the typical compensation and investment patterns in a given industry, a more objective perspective emerges, which allows for informed comparison and assessment of an individual's financial standing relative to their peers. This awareness is essential for individuals, investors, and analysts aiming to understand and predict financial trajectories within specific markets. Without understanding these norms, a simplistic view of net worth can be misleading.

7. Public Information

Public information plays a significant role in estimating an individual's net worth, particularly when verifiable details are limited. This information, often accessible through publicly available sources, serves as a starting point for analysis. Its limitations and potential biases must be acknowledged, as complete and definitive figures are seldom readily available.

- Media Reports and Articles

News articles, financial publications, and biographies may contain details related to earnings, investments, or assets. For instance, reports on business ventures, accolades, or philanthropic activities can provide glimpses into an individual's financial standing. However, these often represent estimations or inferred values, rather than precise figures. Media accounts must be scrutinized for accuracy and potential bias. Similarly, public pronouncements, such as statements or interviews, may hint at financial status, but must be viewed with similar cautious interpretation.

- Social Media Presence

Social media profiles, particularly those of high-profile individuals, can offer indications of lifestyle and potentially expose associated values. Expensive possessions, travel, or notable donations might allude to a high net worth. Yet, the portrayal of wealth on social media is often curated and doesn't necessarily reflect the full scope of an individual's financial situation. Presenting a certain image on social media is common, even for individuals with considerable wealth but who wish to maintain privacy.

- Financial Documents and Records (if available)

Publicly filed financial documents, if they exist and are accessible, provide a more tangible foundation for assessing net worth. These might include financial disclosures, tax returns (if accessible or relevant), or legal filings. However, even when available, such records may not provide a complete picture, may be subject to interpretation, or may not include all asset types. Restrictions on public access to detailed records also limit the effectiveness of this information source. Furthermore, different legal systems and varying disclosure requirements impact the accessibility of such records.

- Publicly Traded Companies (if applicable)

If the individual is associated with publicly traded companies as an owner, executive, or shareholder, publicly available financial data for the company will offer insight. Company financial statements, stock prices, and earnings reports can, however, only offer a partial view of the individual's wealth, as they reflect corporate performance, not exclusively the individual's personal net worth. The correlation between company success and an individual's personal wealth may be tenuous or even non-existent, depending on the specific circumstances.

In the case of Emjay Anthony, examining these publicly available information sources provides a starting point for analysis but should not be considered definitive proof. Extracting insights about their financial standing necessitates critical evaluation and the careful consideration of potentially conflicting or incomplete information. Crucially, it should be combined with other data sources and analysis methodologies to arrive at a comprehensive and accurate estimate of their overall financial position.

8. Transparency

Transparency in financial matters, while not a direct determinant of net worth, significantly influences its perception and potential valuation. A lack of transparency can lead to speculation and uncertainty, impacting how an individual's financial standing is viewed. Conversely, demonstrable transparency fosters trust and credibility, potentially bolstering confidence in the reported net worth. The level of transparency in financial disclosures significantly affects the public's interpretation of an individual's wealth.

Consider examples of individuals whose public financial dealings, or lack thereof, directly impact the public's perception of their net worth. Individuals who maintain high levels of transparency, through documented financial disclosures or public pronouncements, often enjoy greater public confidence in their financial positions. In contrast, individuals with limited or non-existent transparency face scrutiny and potential skepticism regarding the reported or estimated net worth. The resulting speculation and debate can hinder the objective assessment of their true financial standing. This phenomenon applies not just to high-profile individuals but also to businesses and organizations seeking public trust.

Consequently, transparency in financial dealings assumes crucial importance, particularly in the context of assessing and interpreting net worth. The ability to scrutinize and verify financial information strengthens public confidence. This, in turn, enhances the reputation of the individual or entity. A lack of transparency, however, generates suspicion and skepticism. This can lead to a decline in reputation and an erosion of perceived net worth, irrespective of the actual financial standing. Therefore, transparency in financial matters, including financial disclosure policies, is crucial for accurate assessment and credible reporting on an individual's financial position. Ultimately, transparency underpins the public's trust and faith in financial reporting and valuation.

Frequently Asked Questions about Emjay Anthony's Net Worth

This section addresses common inquiries regarding Emjay Anthony's financial standing. Accurate estimations of net worth require comprehensive analysis, encompassing various factors. The information presented here offers a general overview; specific figures aren't definitively available.

Question 1: What is net worth?

Net worth represents the difference between the total value of assets and total liabilities. Assets include investments, properties, and personal possessions. Liabilities encompass debts like loans and outstanding obligations. A higher net worth generally indicates a stronger financial position.

Question 2: How is net worth calculated?

Calculating net worth involves a complex process. Determining the precise value of assets, particularly complex investments or properties, necessitates specialized evaluation. Appraisals are frequently required. Accurate assessment of liabilities, considering various debts, is also essential. The combined analysis results in a net worth figure.

Question 3: What factors influence Emjay Anthony's net worth?

Several factors affect net worth, including income sources, investment returns, and spending habits. Professions, investment strategies, and overall financial management practices within the individual's specific industry also contribute. The precise combination of these factors and their influence vary from case to case.

Question 4: Where can I find reliable information about Emjay Anthony's net worth?

Reliable estimations regarding an individual's net worth are often less accessible than publicly available data. Financial disclosures and official statements are potential resources. However, comprehensive figures are not always readily available due to varying levels of transparency and privacy considerations.

Question 5: Why is knowing net worth important?

Understanding net worth provides a snapshot of an individual's financial health and stability. It offers context when considering investment strategies, financial contributions, or broader societal impact. However, the significance of net worth is not solely financial but can also be related to business influence and impact on society.

Accurate and comprehensive net worth estimation requires careful scrutiny and a multi-faceted approach. Public information serves as a starting point, but it should be treated with caution. Accurate valuations depend on verifiable data and expert assessment.

The following section delves into the multifaceted aspects of wealth accumulation and the elements contributing to financial standing in a given field.

Conclusion

Assessing Emjay Anthony's net worth necessitates a comprehensive approach encompassing various factors. Income sources, investment portfolio performance, asset valuation, debt levels, and expenditure patterns all contribute to the overall financial standing. Industry norms and public information, while helpful, must be interpreted cautiously, acknowledging potential biases and limitations. Transparency in financial dealings significantly influences the public's perception of net worth, impacting an individual's reputation and overall financial image. The available data, while offering valuable insights, does not provide a definitive, precise figure. Ultimately, accurately determining net worth requires rigorous analysis of verifiable data and a thorough understanding of the factors influencing financial health.

This exploration emphasizes the complexity of estimating net worth. The multitude of factors and potential limitations underline the importance of nuanced analysis. While the specific figure for Emjay Anthony remains elusive, the considerations presented here offer a framework for comprehending the factors contributing to financial standing in a specific field or industry. Further research, employing rigorous methodology and reliable data sources, could refine estimations and provide a clearer picture of Emjay Anthony's financial situation. Understanding these concepts is vital for individuals seeking financial security, investors assessing potential risks and returns, and analysts aiming to analyze financial trends.